The Problem With Saving Money

The Problem with Saving Money

So we would all like to have more money in the bank right? To pay for our children’s education, to go on vacation, to retire early.

We want to be financially independent. We want to live a life where we choose what we do for the day, instead of being told to sit in a cubicle from 9-5.

If you’re in the corporate world, you want to have a flexible job working from home. If you’re the stay at home mom, you want to contribute to the family finances and prevent your husband from working such long hours.

There are two ways you can become financially independent. You can save more money, or you can make more money.

Now think for a minute, which method can have a larger impact on your life?

How To Save Money

Use Personal Capital to Save Money

You can track your expenses using an app such as Personal Capital (which is AMAZING by the way). It’s a free app that show you little charts and graphs and monitors your spending so you don’t have to. This post on 8 ways how personal capital stopped my family’s money fights explains in detail how this app can:

*This post contains affiliate links.

- Increase Transparency and Trust

- Establish a Clear Vision for the Future

- Helps manage your cash flow each month

- Allows you to Splurge without Regret

- “Did you pay the ____?” is eliminated

- Demystifies your Investments

- Helps you Save on Fees, for Free

- Turns your Finances into a Game

Use Bullet Journal Or Excel Trackers to Save Money

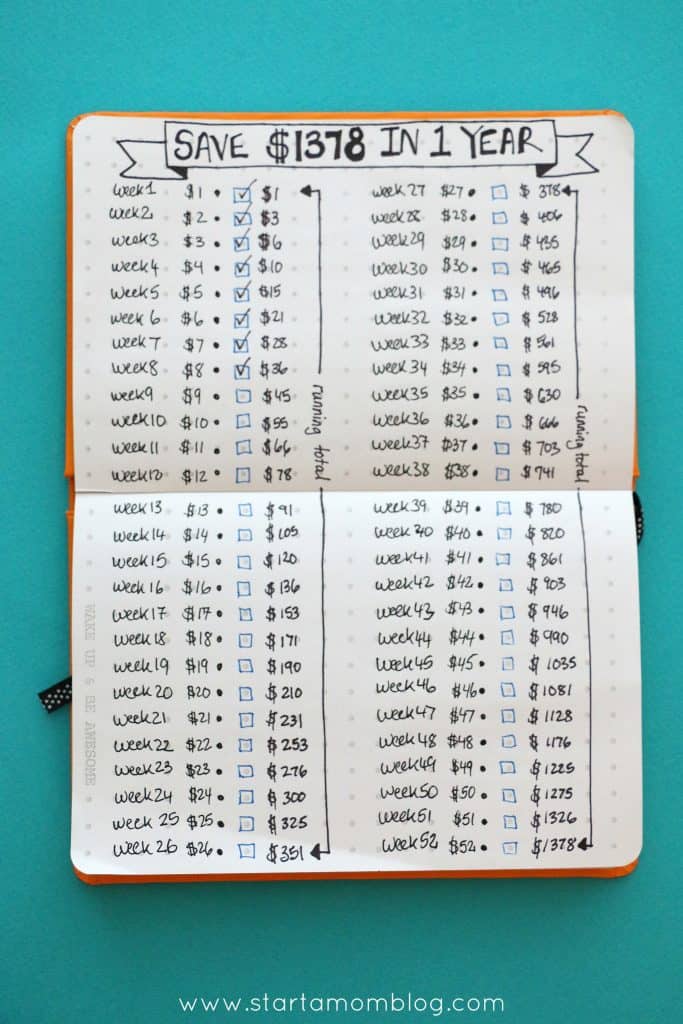

You can go old school and use a bullet journal. Like the spread below that helps you save $1,378 over the course of a year. Each week you save one dollar more, until at the end of the year you will have $1,378 saved!

But what is the main problem with saving money hoping for financial freedom?

The Main Issue with Saving Money

It is Limited!

The one big problem that most people do not understand about saving money, is that there is a limit. If you make $3,000 a month, the maximum amount of money you can save is $3,000 a month. And that is impossible unless you move back in with your parents and live off their food and under their roof. 🙂

You can only save a limited amount of money each month.

For example, you enjoy a Starbucks coffee once a week. That is roughly $4. Over the course of a year (52 weeks x $4) that comes to $208. It took you 365 days to save $208 dollars. That’s a lot of time for a small reward.

Don’t get me wrong. Saving money is great. Especially if you have a very extravagant life style, then you most likely have more places to save money.

Saving Money Does The Follow To Your Lifestyle

- Increases Your Bank Account (slowly)

- Gets You Out of Debt (use the money you save to pay of credit card bills)

- Forces You to Appreciate What You Already Have (this is a mental change that will impact so many areas of your life)

A Faster Way To Financial Freedom

Make Money

In the previous example, if you stopped going to Starbucks every week, you could potentially save $208. But what if instead of focusing all of your energy on saving a few dollars on groceries or gas, you directed that energy at making money instead.

I faced this issue a while back. I was talking to my husband about our finances. We looked at our Personal Capital app and saw that our credit card spending started to decline. We were both very happy. But I told him that even though we saved a few extra dollars that month, it really wasn’t that much. Instead of working so hard to save $20 extra a week, I told him I wanted to make $200 a week instead.

So I researched jobs that I can do while staying home with my two little ones. And I found blogging after seeing the income potential of a blogger.

Now, instead of spending all of my energy trying to muster up enough will power not to go to Target or Starbucks, I use that energy in more creative ways. Not only has blogging helped me save money (because now I have a productive hobby and I’m not shopping all the time) it has also helped me earn over $1,000 extra per month. And I haven’t been doing this for years.

In a few short months I was able to take my blog from making $0 to now making over $1,000 every month. All because I started a blog and used my energy more creatively.

Below is a quick chart of how my bank account has grown just from my blog income. (This does not take into consideration a few affiliates that pay out every 30 days)

If you’re interested in starting a blog too, it’s a great way to build an online business and make money from home. My hobby has put us on a fast track to financial freedom and I want you to experience the same thing.

Many other moms are starting blogs too and enjoying the adult interaction, the creative outlet and the ability to have a flexible income stream.

I am here to help you get started. I even have an ebook that helps you step by step – even if you know nothing about blogging!

Attain Financial Freedom

If you want to attain financial freedom, you have to change your lifestyle. You either have to save money, which is the quickest way to increase your bank account, or you need to earn more money. And starting a blog is a great way to build an online business and grow the lifestyle you want.

I want to help you do this too! I will hold your hand every step of the way to help you become successful!

123

I love your articles

Suzi, I liked your picture “$ 1,378 saved” very much! )) I saved it and printed it out. I need to try this.

Getting active by starting a personal finance blog or social media account is a great way to get started. 1) It keeps you to it. You have fans that want to see you succeed because it gives them hope – it gives you pressure to keep on. 2) It allows others to see that another random person, just like them, can do it too, and maybe has mistakes along the way.

Also, great tip on the bullet journal! It’s both organized and freeing. I like it.

[…] Download Image More @ http://www.startamomblog.com […]

[…] credits from left to right: @karolinaskrafts, http://www.startamomblog.com, […]

[…] By: Start a Mom Blog […]

[…] By: Start a Mom Blog […]

[…] Savings – I love how Suzie from Start a Mom Blog created a goal to achieve $1,378 in a year with weekly milestones. Each week she saves $1 more […]

[…] via startamomblog […]

[…] via Pinterest From crafty enginerd via Instagram From Sheena of the Journal via Pinterest From Start a Mom Blog From An American Girl in a Hong Kong […]

[…] Image Source: @Start a Mom Blog […]

[…] via startamomblog […]

[…] By: Start a Mom Blog […]

[…] By: Start a Mom Blog […]

[…] #3 Saving Tracker Jar via Start a Mom Blog. […]

[…] Credit: startamomblog.com […]

[…] via startamomblog […]

[…] via startamomblog […]

[…] Via StartAMomBlog […]

[…] If you are traveling (or even if you are not), track your savings with this Bullet Journal Savings Tracker. | Start a Mom Blog […]

About save money, I recommend this for everybody … https://bit.ly/2zOmflt

[…] Bullet Journal Money Challenge […]

You make a lot of great points, Suzi! Saving money is great, but you are right-it is limited! Awesome post.

What an inspiring post. I would love to be able to start making money from blogging. But I so agree that blogging is such a creative outlet and instead of spending money at stores shopping I am taking the more creativity route. 🙂

Gurki, thank you for the sweet comment! If not to make money, it does save a lot :):)