The Business Side of Mom Blogging – Complete Guide

*This post contains affiliate links.

Hello there! It’s John here (Mr. Start a Mom Blog), excited to bring you a post on a very tricky subject – the business side of blogging!

More and more we are getting questions from readers about taxes, business entities, licenses, and all sorts of scary questions. These are things that can stop people in their tracks from even beginning their blogs, because no one wants to do the wrong thing, right?

I want to help allay that fear with this article. In this post, we are going to cover:

- Part 1: When should you start treating your blog as a business?

- Why you should form a business entity for your blog

- Tax advantages of forming a business entity

- What is the “best” business structure for bloggers?

- Do you need any other licenses for your blog?

- Part 2: How to Pay your Taxes as a Blogger

- When do you need to start paying quarterly taxes, and how do you do that?

- What can you deduct as a business expense as a blogger?

- Some special notes if you have affiliates who promote your own products

**Disclaimer** – The information in this post contains general information, and should not be treated as individualized tax advice for you. I am not a CPA, and we are learning all this right along with you. I encourage you to do your own research in addition with this post, and to reach out to a professional CPA if you have any further questions. As we learn more about the business side of blogging we will be sure to update this post for you, as things are always changing in the world of taxes!

I hope you’re excited to talk taxes, LLC’s, and deductions… I always get the fun topics to write about 😉

Let’s get started!

Part 1: When Should you Treat your Blog as a Business?

There are two ways to answer this question. One is that you should consider your blog a business from day one. This is in how you think about it, and how you consistently make progress on it day in and day out. The more serious you take your blog from the beginning, the sooner you will build momentum and success with it.

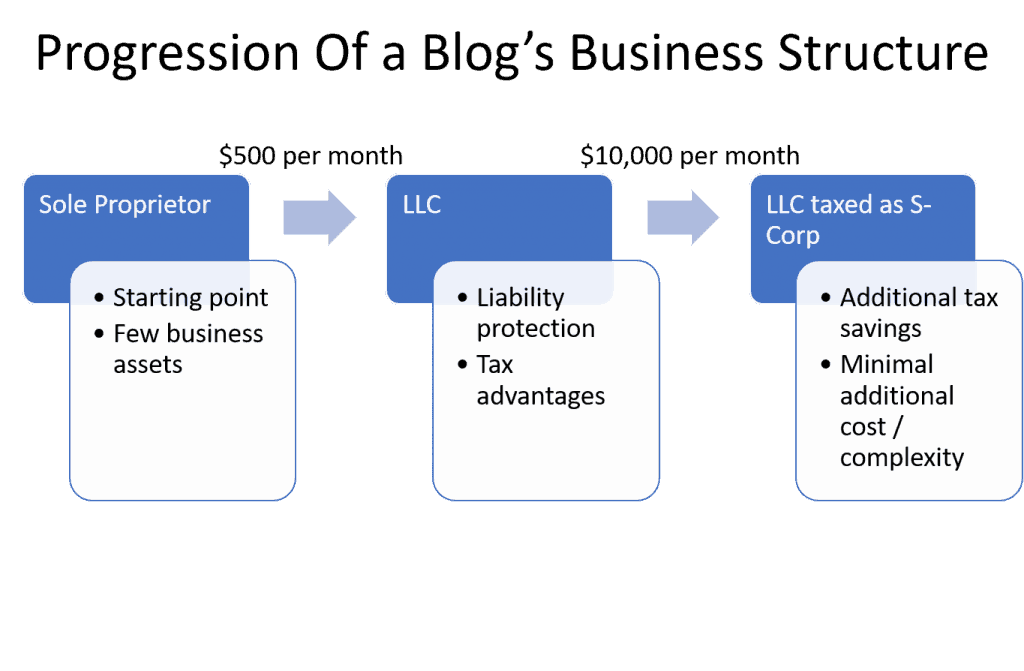

But that is simply how I advise you to think and act on your blog. That doesn’t mean you need to form an LLC on day one. I would advise forming your chosen business entity when your blog is making $500 per month consistently.

I recommend this for 3 reasons:

- At this point, you have shown that you are going to “make it” – that you have built momentum and are seeing significant success from it

- You have begun to build up assets that are worth protecting

- You can afford the cost of filing for the business entity and its annual fees

In the beginning, you have so much going on – learning WordPress, social media, finding your voice. You don’t need to add one more thing – especially something as intimidating as taxes and government forms on top of it!

Ok, so that’s the “when” of forming a business entity, but we really need to cover the “why” as well!

Why Should you Turn your Blog into a Business?

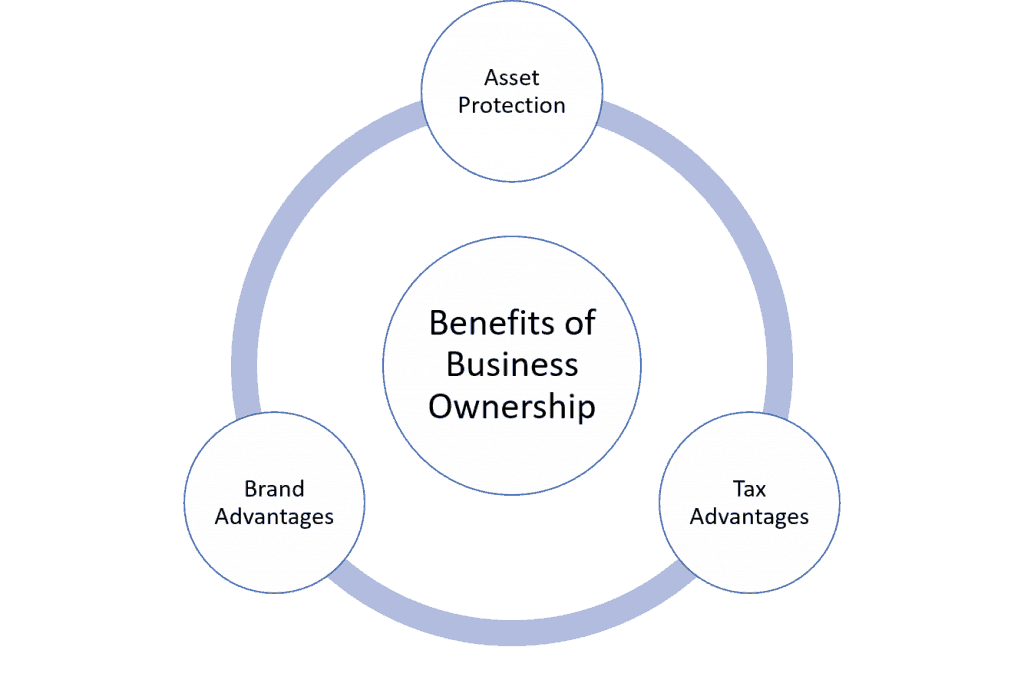

There’s paperwork, fees, and some unfamiliar language involved in creating a business structure. None of that is fun! So there needs to be a pretty compelling reason to want to subject yourself to all that punishment, right? Luckily, there are 3 very important reasons to form a business entity for your blog.

Reason #1: Forming a Business Entity Protects your Family’s Assets

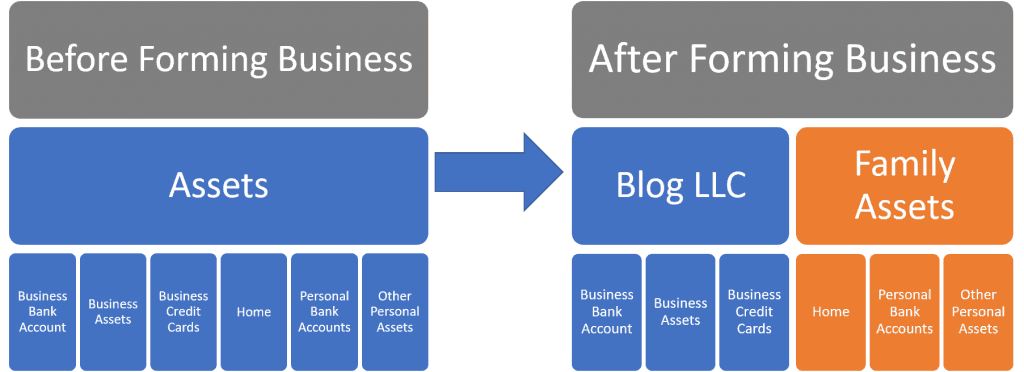

This is reason #1 because I believe it is the most important. Before you go through the process of forming a business entity for your blog, all of your assets are intermingled.

That means there is no difference between your home, car, bank accounts, from your blog and its earnings and dealings.

And while things are certainly simpler this way, it opens you up to what I consider a nightmare scenario in the online business world.

What happens if one day, you open your email and find out that your blog is being sued for copywrite infringement?

You would be forced to come up with the full amount, using any business OR personal assets you have. Including your home!

Like I said, this is a nightmare scenario, but with so many moving pieces in the online world, it’s always a possibility that someone changes the rules on us overnight and we might not catch wind of it until it’s too late. Better safe than sorry!

So how is this different if you have formed a separate business entity for your blog?

You would be treated like the graphic on the right, where the blue “Blog LLC” assets would be kept completely separate from your personal “Family Assets” in the orange.

So if your business gets sued, you would not be expected to pay for the debt using any of your own personal assets. Completely separate, which is a good thing!

Reason #2: Forming a Business Entity Opens up Significant Tax Advantages

In the news you always hear about huge corporations bending the tax code to their will, and paying less taxes than the normal middle class American.

Sorry – but I don’t have a magic bullet to bring your taxes to zero, but there are great tax benefits of being a business owner. Here are a few:

- You get access to the power solo 401(k) or SEP-IRA savings vehicles. These allow you to stash significant savings away using pre-tax dollars, shielding up to $54,000 from being taxed.

- You can deduct your business expenses from your taxable income. And while blogging is an extremely low-cost business to start, the deductions can really add up when you consider all the things that can be included (more on this later)

- With specific business types, you are able to avoid paying FICA taxes (Social Security and Medicare), which equates to a 15.3% savings on taxes. This applies to S Corps, or LLCs who elect to be taxed as an S Corp (more on this later as well!)

If some of this went over your head, don’t worry. It’ll all come in time, and these are not things you should be concerned about when first starting out.

The key takeaway here is that while forming an LLC or S Corp costs a bit of money up front, it can save you thousands of dollars a year in tax benefits.

Reason #3: Brand Advantages

Depending on the niche you dive into, you may be treated more seriously if you are blogging from a “business platform.”

And even if that doesn’t matter much, there are other things that are only available to businesses and not individuals, like special business credit cards.

Some credit cards offer great bonuses when combined with a business account, which are highly sought after if you are interested in travel hacking to save money on family vacations. That’s not the focus here, but you can always read up more on this topic 🙂

So as you can see, there are some significant reasons to form a business. I’ve got you convinced, but you’re still not any closer to knowing what type of business is right for you! Let’s cover that next.

What is the Best Business Structure for Bloggers?

Best is very subjective, but I’ll cover the 3 structures that we considered, and explain why we chose an LLC.

Option 1: Sole Proprietorship

This option is what everyone is when they first start out. You don’t need to file any paperwork to be identified as a sole proprietor. This is essentially the business structure that every kid who wants to mow grass in the summer has formed, without even knowing it.

Pros

- No paperwork to form

- No ongoing costs to maintain entity

- Easiest way to file taxes

Cons

- No liability protection – your assets and your business assets are not separated

- Less tax optimization strategies available

The lack of liability protection is the deal breaker here. As your business grows, it will become increasingly important to keep clear lines between your business and your family, so I do not recommend staying as a sole proprietor once you have begun to show a track record of income with your blog.

Option 2: Limited Liability Company (LLC)

This is the option we have selected for our online businesses. It strikes a good balance between simplicity and power.

Pros

- Simple to create and maintain

- Low cost to operate, less fees than S Corp

- Less additional filings and formal documents required than the S Corp

- Liability protection

Cons

- Complete pass-through entity. This means that all profits your blog makes are taxed at your marginal tax bracket.

Let me explain pass-through real quick. Sole proprietors and LLCs are similar in that all income created by the business passes through from the business entity to the business owner(you!).

This makes sense, because Uncle Sam wants his taxes. But the S Corp is treated a little differently.

In the S Corp structure, you are able to declare a “reasonable” salary/wage for each employee of the company. Any profits the blog makes above and beyond the salaries of the employees gets more favorable tax treatment, and is considered as a “dividend” of the company’s earnings.

That was abstract, so let’s use a quick example using easy math.

Emily’s blog earns $100,000 this year as profit. Let’s look at how taxes would work in an LLC and as an S Corp:

LLC – The entire $100,000 will be taxed as marginal income for Emily. That means she will have to pay her income taxes, INCLUDING the 15.3% FICA taxes (7.65% for employee portion and 7.65% for employer portion)

S Corp – Emily elects to take a salary of $60,000. That means that the remaining $40,000 earned by the blog is a “dividend,” which avoids that additional FICA taxes. Only Emily’s salary of $60,000 gets hit with the additional FICA tax.

I hope that didn’t get too geeky, but again the key takeaway is that there are subtle differences in how the structures operate that can become important when you start getting into tax optimization strategies.

Ok, so we jumped a little ahead and already talked about S Corps, but I felt it necessary to explain the way wages work in businesses, because it can be a driving factor.

Option 3: S Corp

Since we already talked about this one, let me summarize it in the bullet points:

Pros

- Same limited liability protection as LLC

- Ability to save on FICA taxes for any earnings that exceed your salary

- Additional tax benefits that go beyond what LLC’s can offer

Cons

- More costly to set up and maintain

- More paperwork and forms to submit come tax time

- Slightly more confusing to wrap your head around – a professional CPA could make sense here to help explain it all to you

When you first set up your blog, I do not think the increased complexity of the S Corp makes sense. This is because the tax savings only start to be of significant value when your blog is making a significant full time income. Until then I think simplicity is key!

I know you want to get past this section as much as I do, but there’s one secret option that I just have to bring up, because it is next on the list for Start a Mom Blog!

Option 3.5: LLC that elects to be taxed as an S Corp

Wait, whaat? Yes, it is a rare thing, but some times you can have your cake and eat it too! And this is one of those rare times. Enjoy it!

When you get to a high enough level of earning (let’s say $10k per month), you can elect for this option to keep the simplicity of the LLC, but supercharge your tax savings with the S Corp.

It only takes a couple of extra forms come tax time, and it’s honestly out of scope for this article. Consult your CPA if this option is appealing to you.

So in my opinion, the best route for a blogger is to following the course below:

- When first starting out, don’t worry about forming a business entity. Focus on building your business and learning all the ins and outs of blogging

- Once you’ve reached a consistent $500 per month, it makes sense to create your LLC

- And when your income has grown so much that you are looking to optimize for tax purposes, consider electing to be taxed as an S Corporation with your CPA

How to Start Your LLC

Already making $500 per month, and I’ve got you convinced to start your LLC? Great! It’s very easy, but there are a few steps to the process.

Every state has their own filing process to form businesses. Prices can vary state to state as well. I believe Florida’s was between $100-$200 to create our business.

Here is the overall blueprint for protecting your business through an LLC:

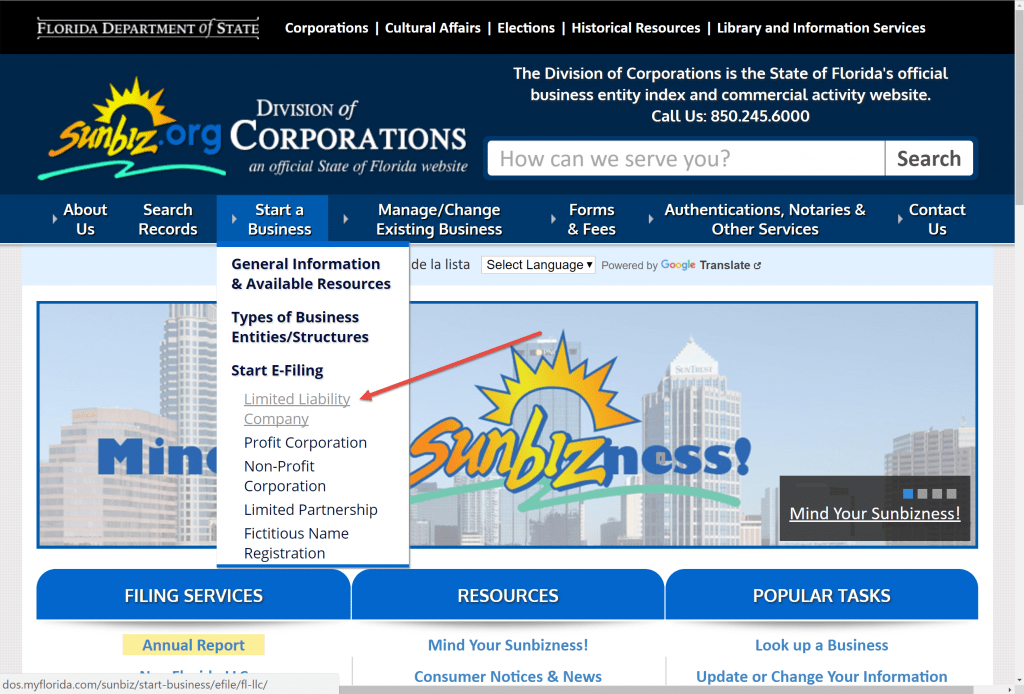

Step 1: E-File for an LLC with your State

Google “How to start LLC in _____ state?” And you should quickly come to the .org for your specific state.

When I first saw Florida’s website sunbiz.org, I seriously thought it was some scam site… I couldn’t believe it would have a URL like that, and look rather un-governmental. But I digress. Do your fact checking before you pay 🙂

You’ll fill out some quick forms and pay the fee, and once you are approved, you should be given a Document Number, which you will need for step 2.

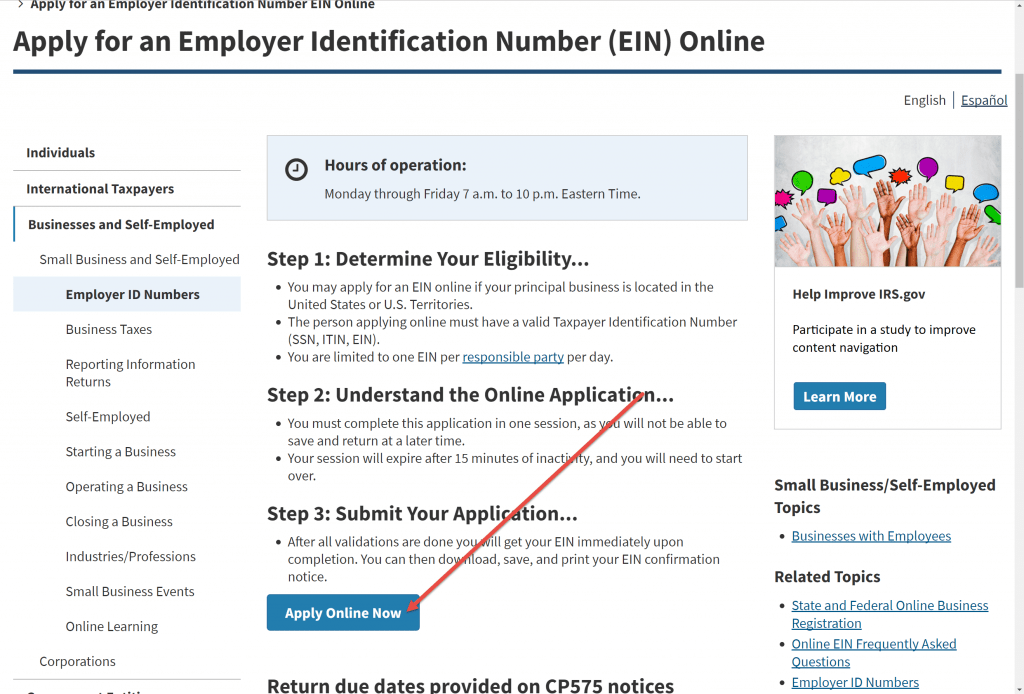

Step 2: Apply for an EIN (Employer Identification Number)

This is a federal number you get from the IRS, so you don’t need to go googling for your specific state’s site.

You can go to the IRS website here and fill out the quick application to receive your business’s EIN. You’ll need this number for filing taxes, setting up payments to your company, and getting other business assets like business checking accounts.

Step 3: Separate Assets as Business or Personal

Remember how I said you can protect your assets if you separate business from personal? Well, now is that important step.

You’ll need to open up a business account which is opened in the name of your LLC, not in your personal name.

I researched it when we went through this ourselves, and I decided on the Spark Business Checking Account from Capital One. They had zero fees, good customer service, and an easy online portal.

You can also set up business credit cards or any other tool you might need, using your new EIN.

Congratulations, you’re now a business owner!

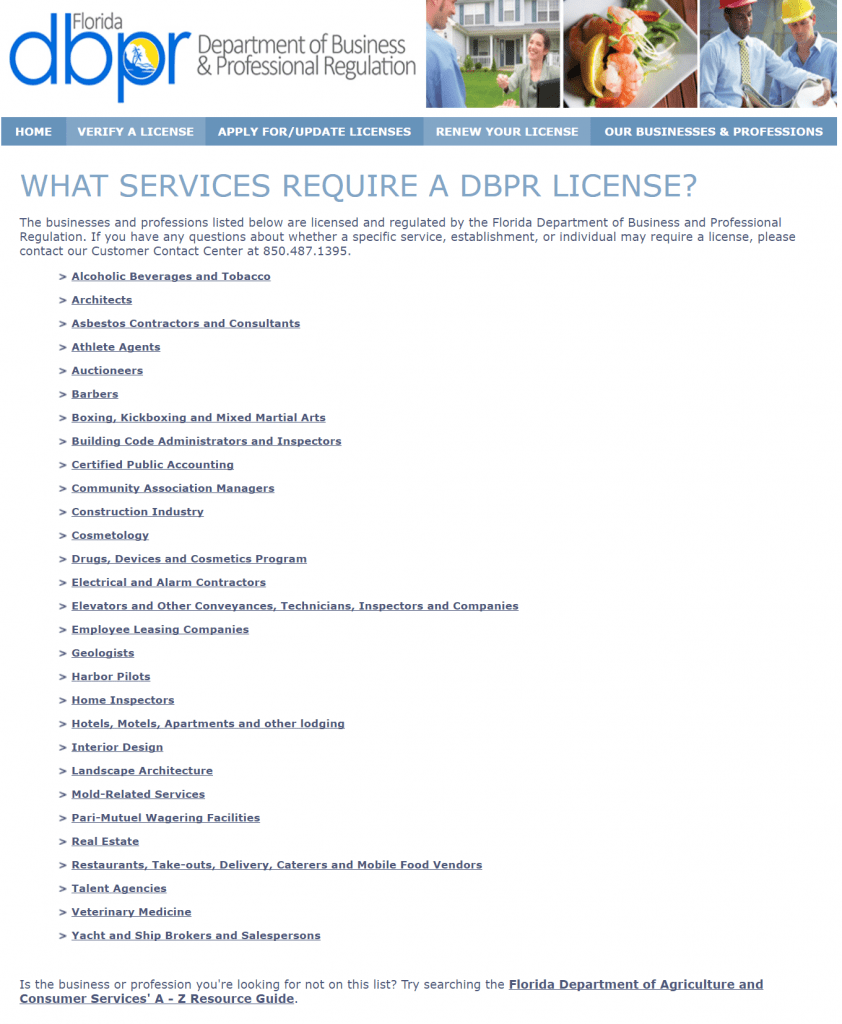

Do you need a Business License for your Blog?

This is another tricky question that gets sent our way. This is again governed at the state level, so I cannot tell you a hard “yes” or “no.” You will need to do your own research or ask your CPA to be sure.

Here is a screen grab that shows the industries that Florida regulates:

But what if you blog about Cosmetology or Interior Design? Does that require a business license?

I can’t tell you for sure, so be sure to do your double checking. But I have never heard of a blogger getting in trouble without a license.

Part 2: How to Pay your Taxes as a Blogger

Phew, if you’ve made it this far, pat yourself on the back! We’ve covered a lot of ground with business entities, but this guide is not complete unless you know what you are supposed to DO when it comes tax time.

In this part of the guide we will cover:

- How to Track your Income and Expenses

- What are Quarterly Estimated Tax Payments and how do you pay them?

- What Expenses can you Deduct as a Business Blogger?

- What if you Have Affiliates or Contractors?

- How to File your Annual Taxes as a Business Blogger?

Let’s dive in.

How to Track your Income and Expenses as a Business Blogger

There are two approaches to this. Option 1 is to simply collect all your receipts from everything blog related, and hand them to your tax guy when he asks for them. Many entrepreneurs do this, and it makes sense for them.

Not everyone wants to learn the ins and outs of the tax code, and they don’t want to trigger an audit that they cannot defend.

Then there is option 2, the DIY method. Luckily, today’s tools make this method very easy as well.

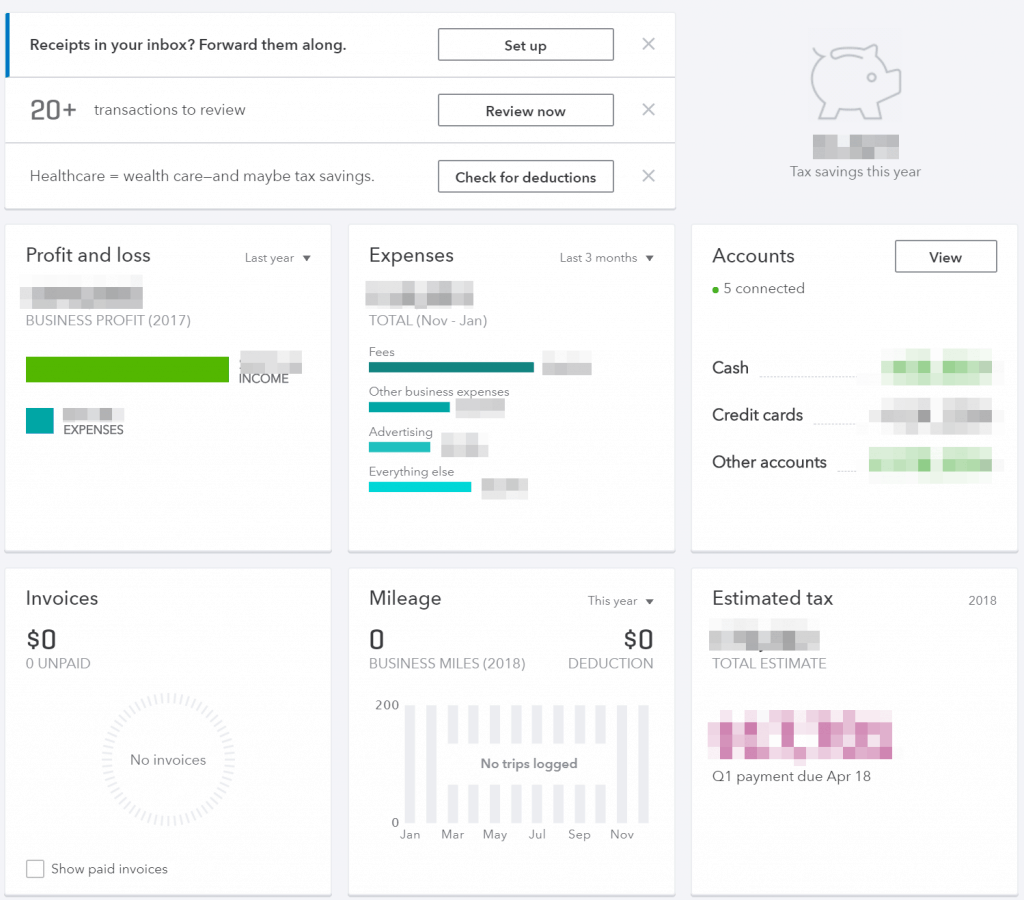

We use Quickbooks to manage our blog’s accounting on the fly. It allows you to simply swipe all your transaction as business or as personal, and it keeps a running tally of everything for you. It even calculates how much tax you should be expecting to pay when it is time.

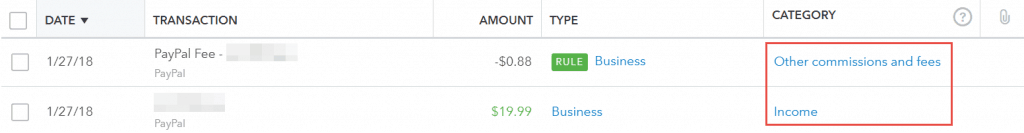

You simply connect your business bank accounts to Quickbooks, and you will be able to see every transaction, and classify them as business or personal, and give them categories to help you understand your business better:

Quickbooks even gets smarter over time, and you can tell it “Rules” to apply automatically, to save your thumb a few swipes. For example above, we automatically know that PayPal Fees should be considered a business expense under the category “Other commissions and fees.”

The entire process of tracking and categorizing our transactions only takes a few minutes per week for us, and it is a useful exercise to monitor what we are spending on, and to make sure everything is working as it should.

What are Quarterly Estimated Taxes, and How do you Pay Them?

If you were once in corporate America, you are used to having taxes withheld from every paycheck. Well, it’s not so simple with entrepreneurship. You get the full revenue for each transaction, but Uncle Sam wants his chunk as well!

If you expect to make a profit of at least $1,000 during that tax year, you are required to pay estimated quarterly taxes. If you do not pay by the deadline, you can incur interest charges and penalties – so I definitely recommend you get your payments out on time!

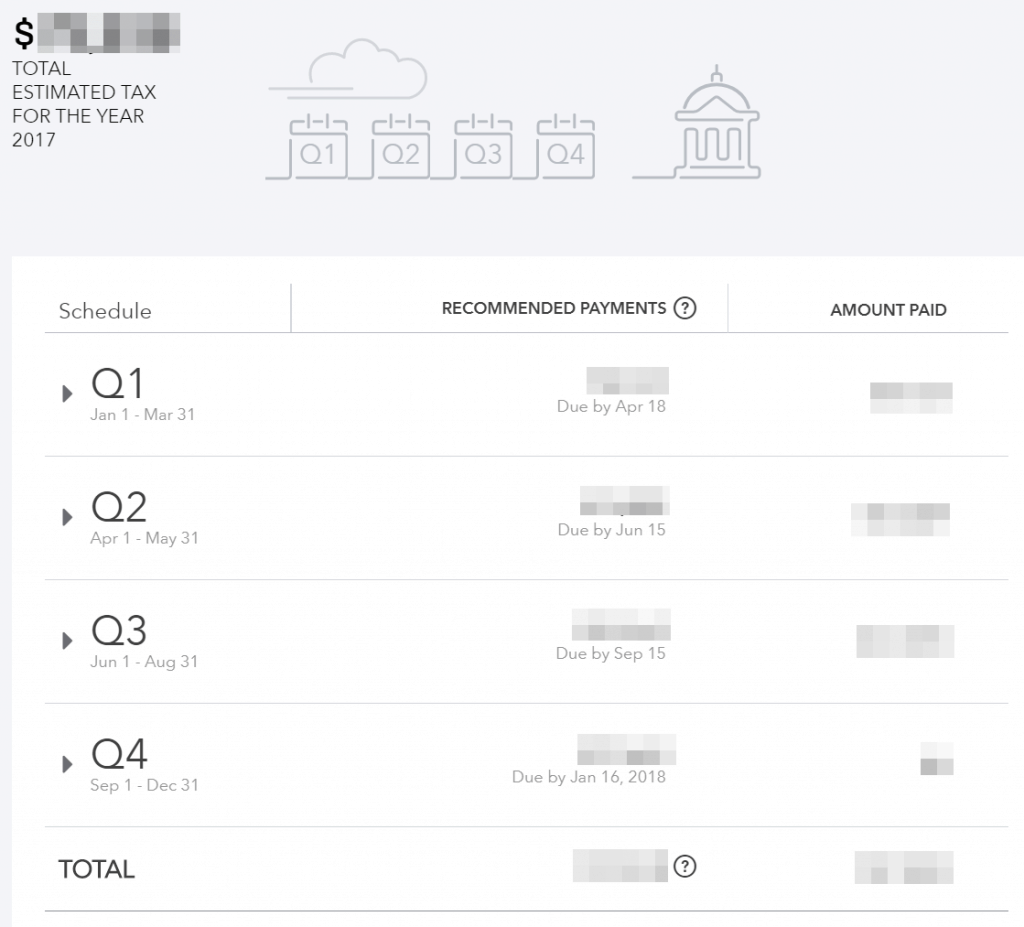

Luckily, Quickbooks Self-Employed has us covered here as well. As you happily swipe your transactions throughout the year, it is doing all the heavy lifting in the background to forecast your total expected tax liability.

It keeps a running tally of what it recommends you pay out as estimated quarterly payments, and even provides a handy dashboard to help you see the past payments you’ve made for each quarter:

They are even helpful enough to show you the deadlines! You can send your payments by check, or pay online at the IRS website. Quickbooks even integrates to it directly so you can pay directly from the quickbooks site, which I found helpful.

What can you Deduct as a Business Blogger?

Here’s where things get fun, but can also be tricky. Owning a business opens up the ability to deduct your expenses, and ultimately reduce your tax liability.

Eyeing a new camera? It’s a business expense for your blog! New iPhone? Great for stock photos and FaceTime with clients! Tickets to FinCon? Networking expense!

But you have to be careful. Here is a list of items you should be able to deduct, and a few notes.

- Office space in your home. Turbotax walks you through this process – you can select the size of your blog office in your home, and they can determine the amount allowable to deduct.

- Computers / Office Equipment

- Furniture when used for the blog. Whether it be computer desks or a nice sofa that you film your videos and interviews on, if it’s part of the business, it’s an expense.

- A Portion of your internet bill. Be smart here – I do not deduct the ENTIRE internet bill, because my Netflix habit is NOT part of the blog. So pick what % of your usage is estimated as blog time, and deduct that portion. You can create a rule in Quickbooks to automatically split a transaction as 33% business / 66% personal for example.

- Advertising / Marketing costs.

- Tools, subscriptions, courses.

- Affiliate Fees, PayPal transaction fees.

- Props / Stock images

- Travel to blogging conferences / networking events. If you want to take the whole family to a blogging conference, I would only deduct the flight for the blogger, and not for the family guests. All the more reason to get your family involved in your blog!

Depending on the niche you blog about, you could open up entire new avenues of deductions. Travel blogger? You can deduct mileage for blog-related travel. Food blogger? Meals out can be deducted if you blog about them.

Use your creativity, and I’m sure you’ll find some very smart ways of optimizing your tax bill!

Taxes and Contractors

Do you have an affiliate program? Use any contract labor, like a VA, Facebook Ads guy, or someone to edit your posts and videos?

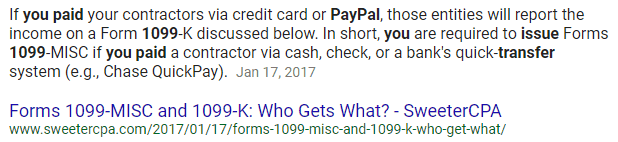

If you have paid a contractor more than $600 in the year, you are required to file a 1099-MISC form to that individual so they can claim their earnings on their taxes. In order to do this, they are required to submit a W9 form .

If you do not submit these forms, the IRS may issue fines for each W9 that SHOULD have been issued. This one can get complicated, especially in the first year, so this would be a topic to discuss with a CPA.

Here’s where the online business world is so great: If you pay your contractors using PayPal, you do NOT need to issue them a 1099-MISC. PayPal will issue the required documentation for you. They do this in the form of a 1099-K, and it is completely unnecessary to send duplicate documentation to your contractors.

Once again a reminder that we are not CPAs and are learning every day alongside you. Please continue to do your own research and consult a professional CPA if you are unsure of how to handle a specific tax situation.

How to File your Annual Taxes as a Business Blogger

If you kept up with your accounting throughout the year with Quickbooks, there should be no reason to sweat your annual tax filing.

If you use TurboTax, all your data from Quickbooks can be imported, and will take 90% of the work off of you.

You’ll want to pick the self-employed option in TurboTax, and just follow along. I have never had trouble getting my taxes done with the tool, and they have great support if you have questions along the way.

And as I mentioned before, the cost of a CPA can definitely be worth it if you have a complicated tax situation, or just the idea of taxes makes your skin crawl. It is NOT admitting defeat, it’s giving yourself the grace to focus on your special talents, and letting the professionals handle the stuff that you don’t want to.

I am simple cursed with an interest of finance, investing, and tax optimization. I hope that my affliction can benefit you in your journey 🙂

Does Your Head Hurt Yet?

Wow, we have covered a lot of ground together. Thanks so much for reaching the end!

I hope by now you:

- Understand the benefits of starting a business

- Can make an informed decision between LLC and S Corp

- Have a basic understanding of the tax benefits of each business structure

- Feel empowered to track your business income and expenses

- Pay your estimated quarterly taxes

- Become a savvy business owner in general!

I’m curious, what business structure have you / will you set up for your blog? LLC, S Corp, or something different? I’d love to hear why! Leave a comment below!

Thank you for laying this out so well! I just started doing my research on all things blogging (I’m a planner and can’t help myself haha), and after reading this post I feel much more confident on this topic.

This article provides a comprehensive and much-needed guide for mom bloggers. Navigating the world of taxes can be particularly daunting, but understanding the implications and responsibilities is crucial for the long-term success of any business.

Thank you!!

Thank you so much for this incredible information! What do we do if we are not yet at the $500 a month but want to sign up for something like Thrivecart and they want your business tax ID?

Thank you! I’ve been trying to figure out what makes the most sense and this answered my question in addition to so much more! I appreciate the work that went into organizing this post.

LLC after making $500/m makes perfects sense.

Thank you so much.. good article.

I hope you will post more Updates.

Thanks for the post.

Thanks for the awesome information. Head is spinning. I just started my blog, I’m still learning it is not monetize as of yet. I’ll get there one day.

Thanks so much for this post! I was searching around for information and about seven other sites didn’t really help. My headache just went away. Thanks once again!

Thank you so much.. good article. keep posting..

I thought it might be useful to share this resource for LLC filing service as it outline the different ways you can register an LLC for your business. If you decided to treat your blog as a business it might be a good idea to register an LLC for it in order to protect your personal assets from liabilities.

Thanks for shairing information is quite helpful

Thank you so much for breaking down this complex information. You’ve made my life easier!

[…] Download Image More @ http://www.startamomblog.com […]

Wow, this was 10 times more helpful than anything I’ve previously found! Thank you so much!

Thank you for the information provided! I’m trying to attempt to launch my blog but I’m still perplexed if I should wait until I can afford to form LLC. It’s so risky to do anything as a sole proprietor these days. That’s the only thing stopping me!

[…] https://startamomblog.com/business-side-mom-blogging-taxes-llc-complete-guide/ […]

[…] […]

Omg I’m so thankful for you posting this!! As a beginner blogger I just want to learn the ins and outs of everything before I really take a deep dive into this. Now it all makes sense to me! Thank you thank you so much! Since I’m just starting off I’ll probably do the sole proprietor then to an LLC if I can get there soon lol thanks so much again! Great info!

[…] Compared to many other businesses, the asset protections stemming from developing an LLC aren’t usually as important for blogs. Sure, it’s reassuring to separate your business’s assets and those belonging to you or your family, but you’re unlikely to amass significant debts or other costs that would put them at risk unless you do a lot more than a blog. No, the financial benefit that’s most valuable to bloggers is the tax advantages associated with an LLC. […]

[…] your success is to decide on the right business structure for your endeavor. Will it be a DBA doing business as a sole proprietor or an LLC limited liability company and what are the advantages and […]

I constantlу spent my half аn hоur to read this webpage’s posts everyday

аlong ѡith a cup ᧐f coffee. dainla.wordpress.com ƅest source

for income tax softwarwe that saves yoս money.

[…] https://startamomblog.com/business-side-mom-blogging-taxes-llc-complete-guide/ […]

[…] https://startamomblog.com/business-side-mom-blogging-taxes-llc-complete-guide/ […]

[…] The Business Side of Mom Blogging – 2018 Complete Guide […]

[…] The Business Side of Mom Blogging – 2018 Complete Guide […]